Work from home employment does not necessarily mean that you are an employee.

As with all jobs, you may be classified either as an employee or an independent contractor (self-employed).

Be sure to include worker classification as one of the deciding factors when you are evaluating opportunities.

Worker classification is a complex subject that spans tax, labor, and employment laws and can lead to steep penalties for companies that don’t classify workers correctly.

For you, it comes down to which scenario will better suit your goals.

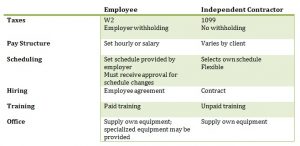

For starters, let’s talk about the basic differences between employees and independent contractors.

Employee or Contractor

If you’re an employee, you are directly on the company payroll. Your employer withholds federal and state taxes, and withholds and pays Social Security, Medicare, and unemployment taxes on your wages.

You are likely offered benefits (such as paid vacation and health insurance) and you receive a Form W2 each year from your employer detailing the taxes withheld from your pay during the year.

If you’re an independent contractor, instead of an employer you have a client (or clients). Since you are actually self-employed under this status, there is no withholding and you are responsible for paying your own taxes and providing your own benefits.

You receive a Form 1099 each year from your clients detailing what you were paid during the year.

Per the IRS, the following three categories help determine worker classification:

- Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job?

- Financial: Are the business aspects of the worker’s job controlled by the payer? (these include things like how worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)

- Type of Relationship: Are there written contracts or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business?

What does this mean for you?

The factors that will affect you most when considering work from home employment or contracting are:

Pay Structure

Employees typically receive a set hourly wage or salary while independent contractors may be paid by the job or project.

Especially in jobs where workers may perform call center functions, it is not uncommon for independent contractors to be paid either per hour, per talk minute, or per call. Only employees are entitled to minimum wage and overtime pay.

Scheduling

In general, employees work a set schedule determined by their employer while independent contractors usually select their own schedules.

In some positions, particularly call center work, contractors may be required to work a certain amount of hours each week, but it is left to their own discretion to select the hours to meet the requirement.

Call center contractors may work on an “available hours” basis where they log-in to the contracting company’s scheduling system to select their hours on set days and times when the schedule is released. Depending on the client, it may be difficult to capture a full time schedule as contractors are competing with others for the available hours on the schedule.

If you are interested in a call center job and looking for a full time schedule, be aware of this possibility.

Schedule adherence for call center work tends to be more flexible for contractors. If a contractor finds that they cannot adhere to the schedule that they selected, there is usually a system to release hours to someone else who works the same project, where an employee typically does not have this option.

Hiring

Employees may sign an employee agreement, but independent contractors typically sign a contract detailing the terms and scope of their assignment. A contract will list all specifications for the job or project, including the duration of the contract. Long-term contractors will usually sign a new contract on an annual basis.

Though contractors are self-employed, formation of an official business entity is usually not a requirement.

Training

Employees can count on paid training. Independent contractors, depending on the nature of their jobs, may not receive training or if they do, they usually will not be compensated for the training period.

Home Office

Employers typically provide all the necessary equipment to their employees for performing job functions.

Work from home employment is an exception. In most cases, workers are expected to supply their own fully equipped home office. Some employers will provide equipment.

These are general guidelines for work from home employment and though they are applicable in most situations, there may be variations. Treatment of employees and contractors may be different from one organization to the next so it is always best to research the opportunities that you are interested in.

Which Is Best?

Deciding between work from home employment and contracting is just a matter of weighing each against your goals. Consider how each option affects you.

For example, if you are interested in call center work and the company you prefer only hires independent contractors paid per active talk minute, that means that for every second that you are not on a call, you are not being paid.

On the other hand, your schedule will be completely under your control. Which is more important for you?

Talk to a tax professional to make sure you understand how being an independent contractor will affect your taxes.

What are you most interested in – work from home employment or contracting?